Investment and Operational Philosophy

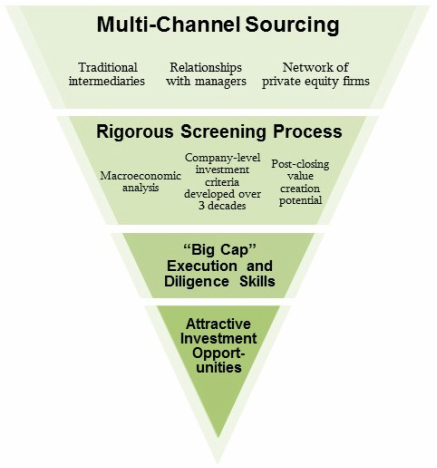

Deal Sourcing & ScreeningEmpeiria focuses on businesses that meet stringent investment criteria developed by its principals over the past three decades.

We generally focus on acquiring companies with EBITDA ranging from $5 million to $20 million. |

Value Creation PhilosophyEmpeiria's plan for value creation in "turn-up" situations typically involves some or all of the following elements:

Revenue enhancement:

Operating efficiencies:

Strategic repositioning:

In the Empeiria team’s realized buyout investments, aggregate EBITDA expanded by an average of approximately 50% between the times of acquisition and exit |